2023 Healthcare

Prognosis

Our collective crystal ball was pretty cloudy in 2022. It is true that SPACs were not a popular route to the public markets last year (dropping from 613 in 2021 to 86 in 2022 and 44 in Q1 2023 annualized). And while we missed when predicting that Teledoc’s stock price would rise, the other two “fallen angels” selected to rebound fared better, but really as a result of M&A (One Medical acquired by Amazon; Oak Street Health acquired by CVS). We goose-egged liquidity, as all three companies selected as favorites to go public in 2022 remain private (VillageMD, Omada, Hinge Health). In addition, the Republicans were predicted to sweep the House and Senate, but the Senate remains in Democratic hands. In all, other than the Senate results (and the continuing juggernaut that is Optum/UnitedHealthcare), our performance here feels pretty much like our performance everywhere else over this timeframe. But hope springs eternal!

Here in 2023, Covid is in the rearview mirror while high interest rates, weight loss drugs, and ChatGPT/AI are all the rage. Oh yeah, and a stunningly efficient bank run shocked the world… Below is our commentary on the most interesting findings from this year’s survey, followed by the full results.

I. COVID-19

While Covid remains a leading cause of death in the US, the pandemic is winding down and people are doing their best to move on and adjust to the “new normal”. Companies are also trying to find their go forward balance, with the trend shifting to bringing employees back to the office. While remote work had its moment, the consensus today appears to be moving towards in person being far superior to remote work (at least for the organization!).

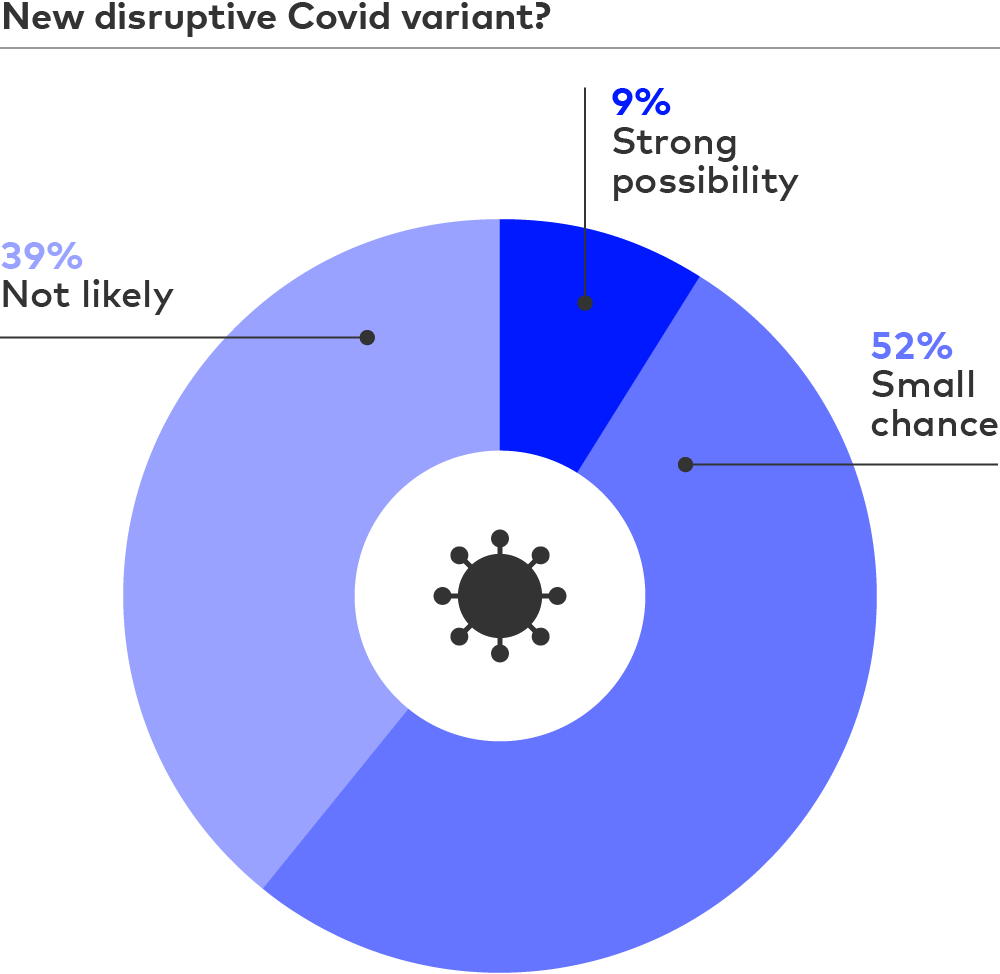

DISRUPTIVE VARIANTS

Fortunately only a small number of folks believe there is a strong possibility of another Covid variant disrupting life, and we hope they're right!

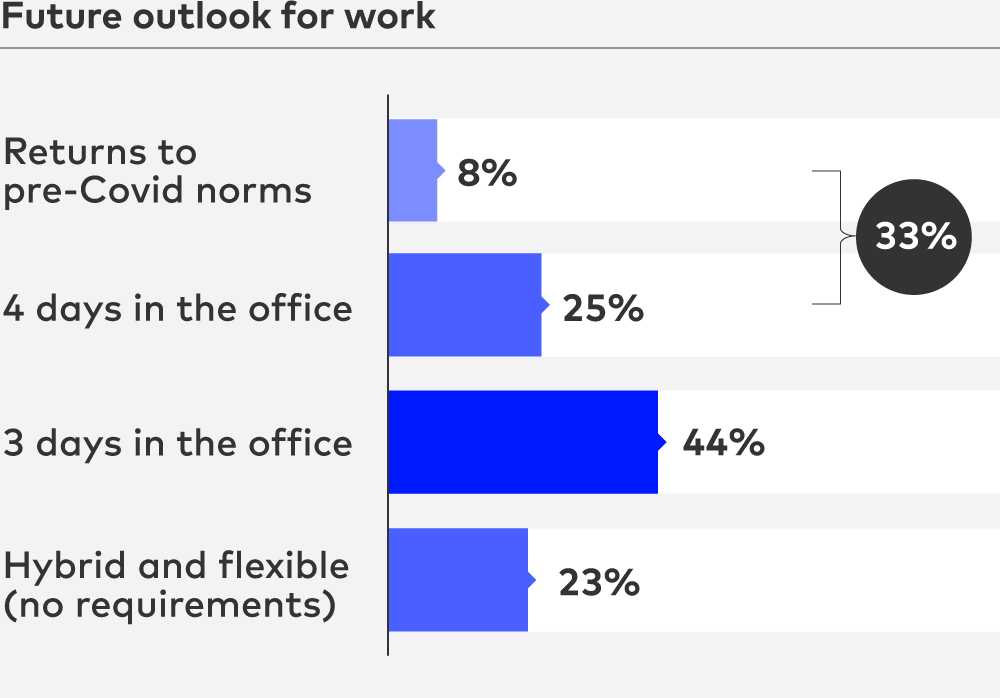

RETURN TO THE OFFICE

Last year, 40% said that employers would encourage the use of offices, but leave it to employees to determine their schedules. Now, big tech companies such as Apple, Amazon, and Google have issued return-to-office mandates for at least 3 days and Wall Street is fully back in the office, at 5 days in person. Only 33% think that people will be in offices for 4 or more days. We also wonder if people will go back to something dressier than athleisure.

II. FINANCIAL INDUSTRY

High inflation and bank runs, more Reductions in Force (RIFs) and down-rounds made for a wild Q1 and a very difficult to forecast rest of 2023.

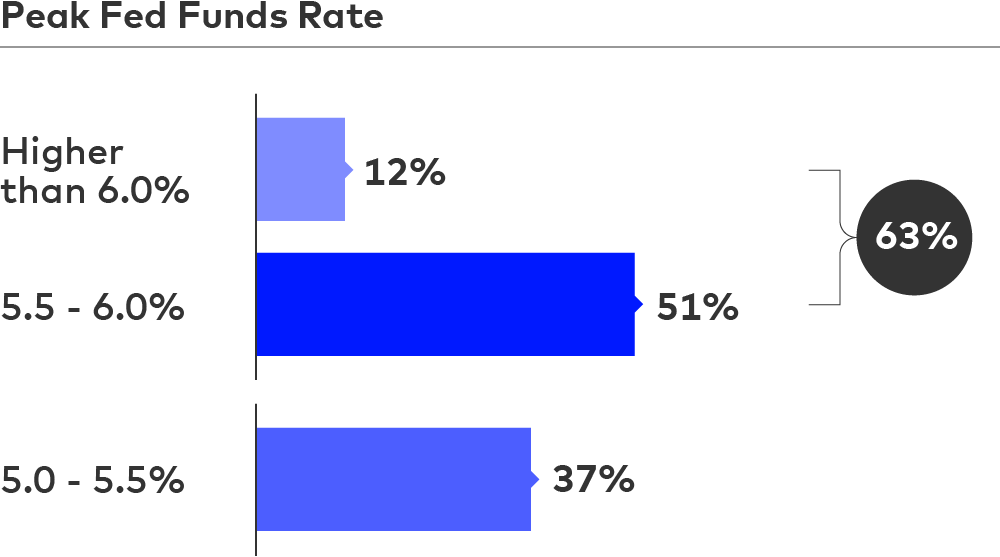

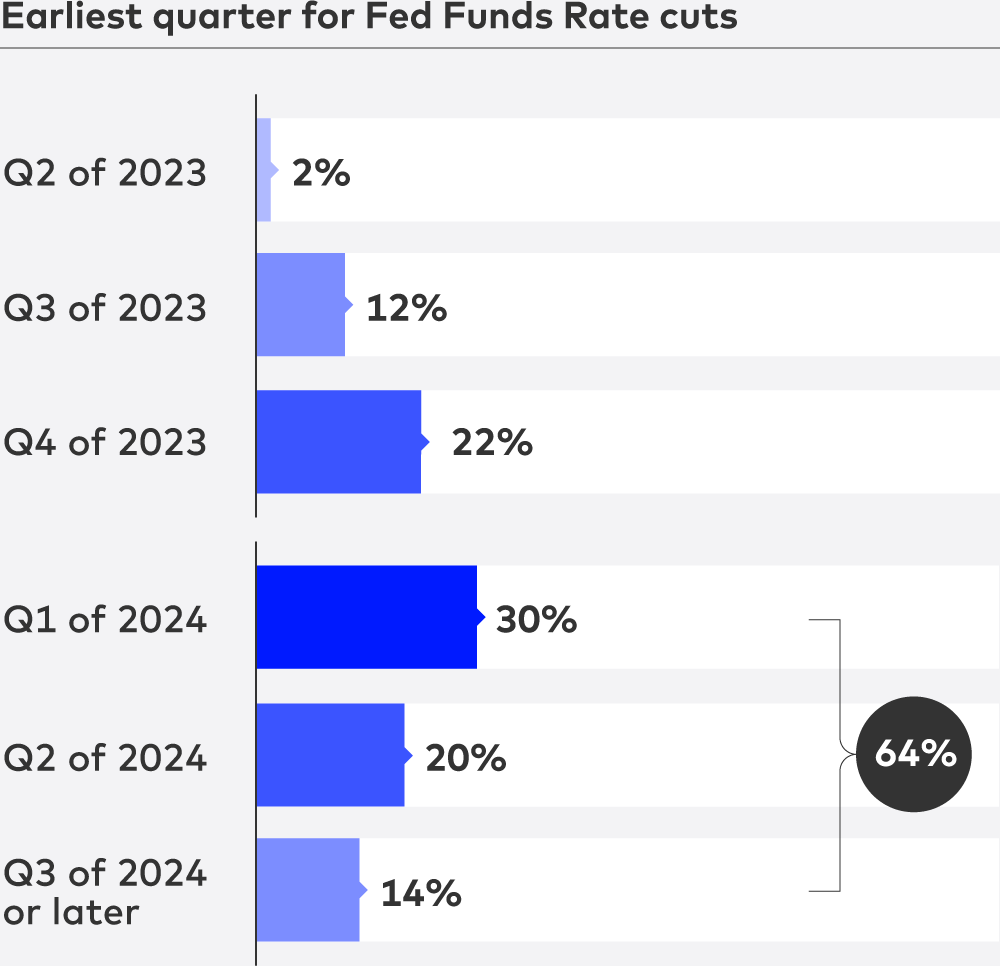

INFLATION V. FED FUNDS RATE

Combating inflation remains a top priority, but rising interest rates have their downsides. This group’s predictions for the Fed Funds Rate is a higher peak, and longer duration, than previous Wall Street consensus projections of 5.0% - 5.25% and lowering in 2H 2023. So we are bracing for things to get worse before they get better, which may be true after the May 3rd rate hike and ambiguous guidance for June, or maybe the healthcare community that we surveyed is just more bearish than the average bear after the last few years.

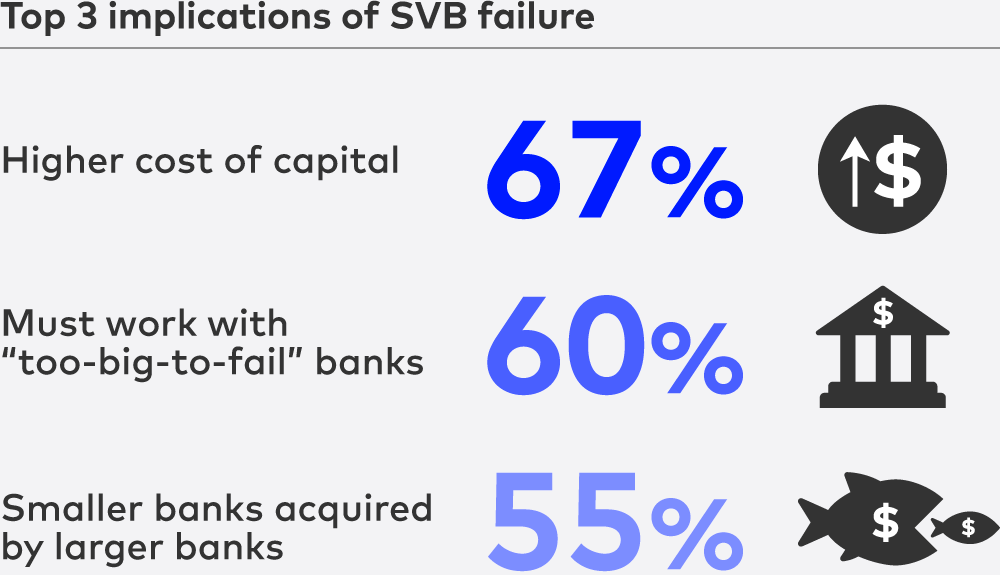

SILICON VALLEY BANK 😢

SVB’s swift downfall will have repercussions for years to come and now First Republic Bank has followed suit, but what downstream effects will hurt the most for the startup ecosystem?

III. THE STATE OF HEALTH TECH

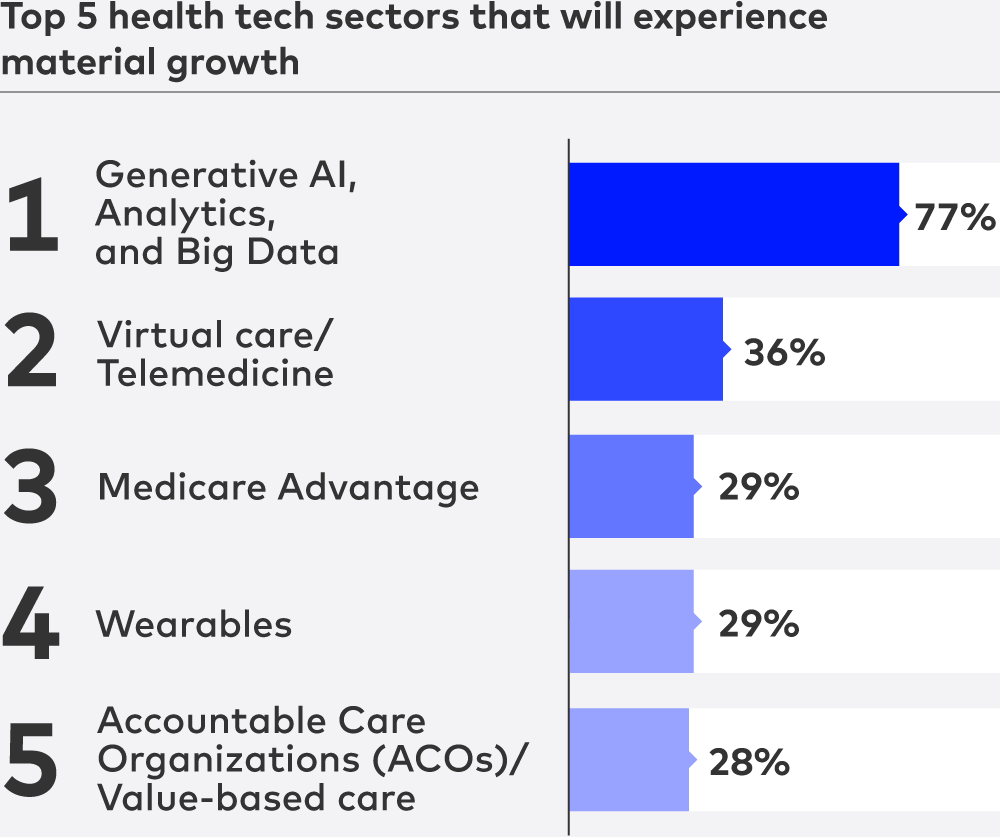

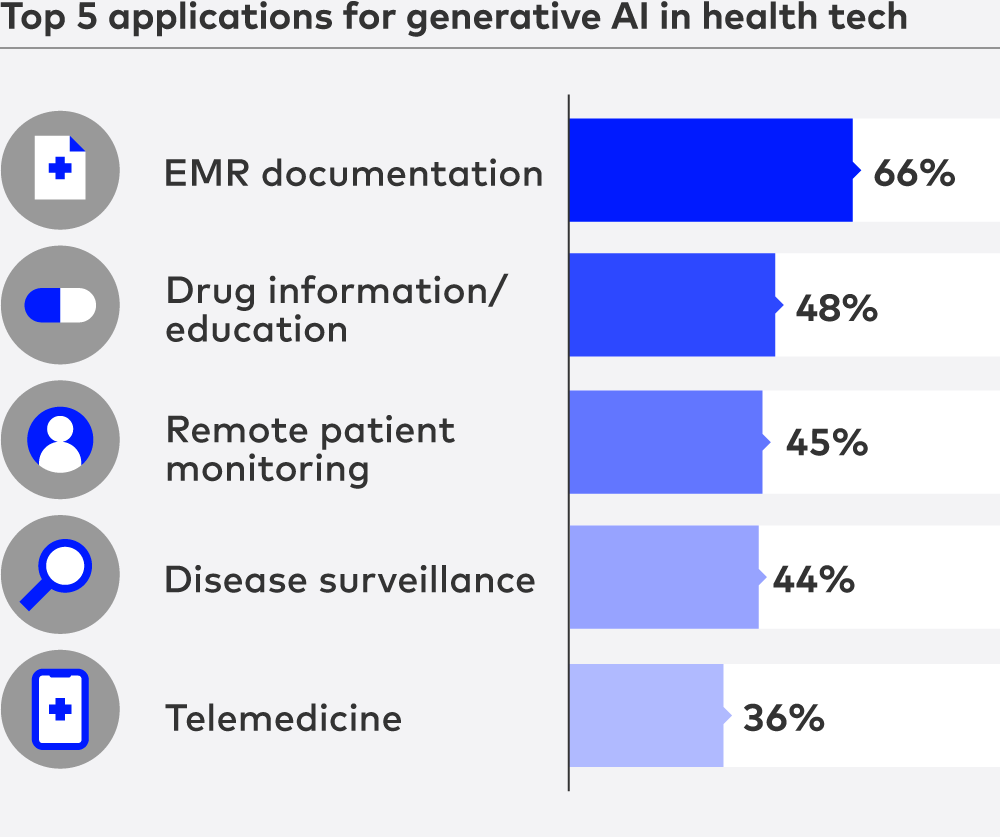

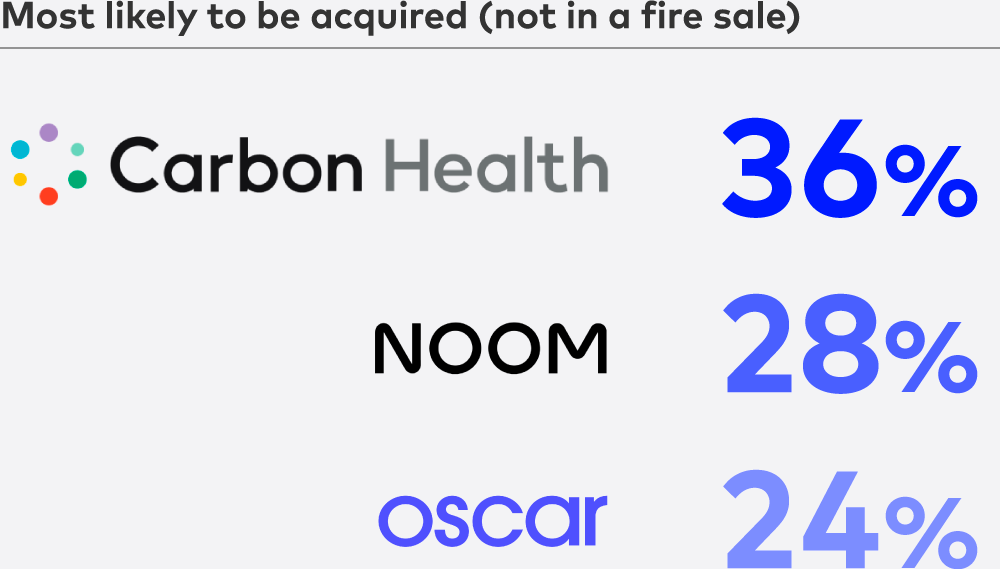

Generative AI sensation ChatGPT sparked renewed interest in AI’s ability to change the world and health tech was no exception. But it’s not all sunshine and roses… as startups face a difficult funding environment, M&A is expected to become a more common option.

WHAT'S HOT IN HEALTH TECH? AI!

Generative AI was the runaway favorite, when asked which health tech sectors would experience material growth. A year ago, who would have guessed that value based care “darlings” (Medicare Advantage and ACOs) would be neck and neck with wearables?

RIPE FOR ACQUISITION

As the current environment is expected to spur consolidation, some companies will find that M&A offers the best path to continued growth.

IV. DRUGS

Ozempic is everywhere - subway ads, the Oscars, and Saturday Night Live - while mifepristone may soon be nowhere - let’s hope not (please, please, please Supreme Court). Drugs are in the spotlight and drug pricing continues to be a mostly unanswered promise, however, the Inflation Reduction Act (IRA) has the pharma-biotech ecosystem on high alert… after many years of an SEC football-like policy winning streak.

GOT OZEMPIC?

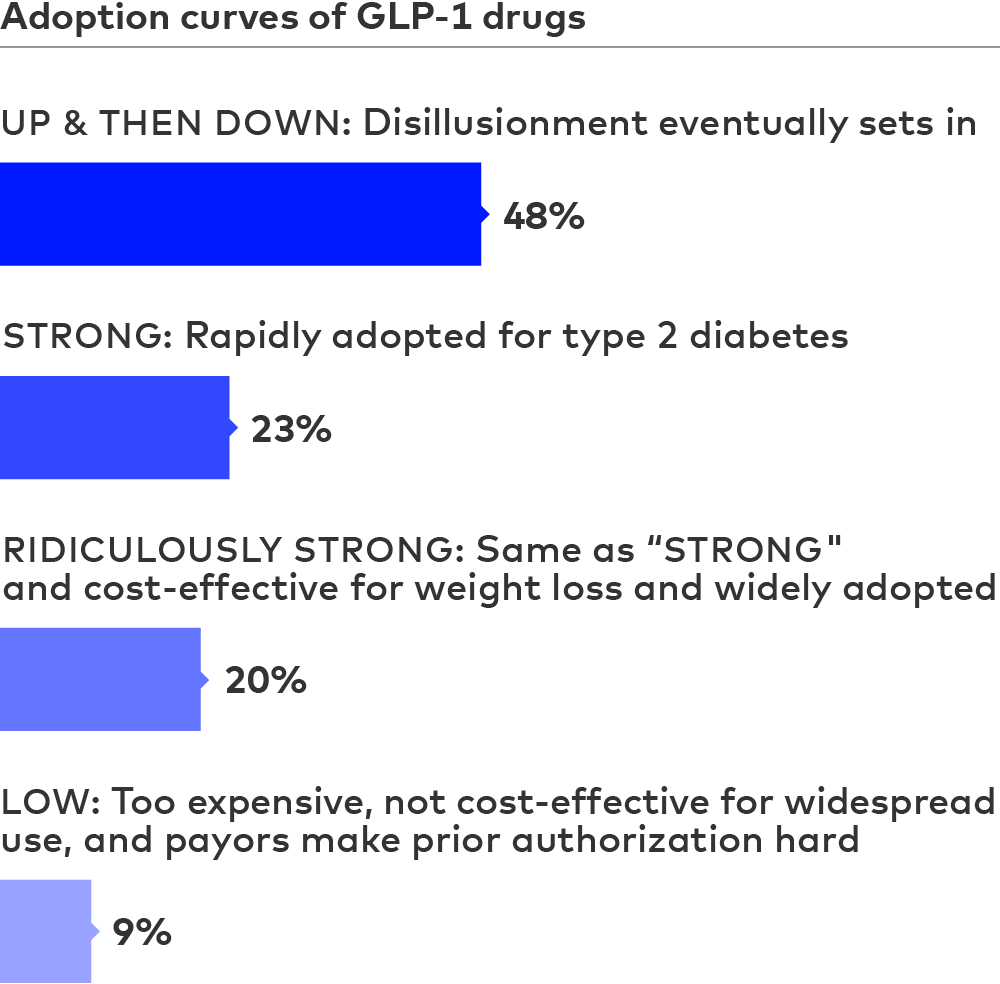

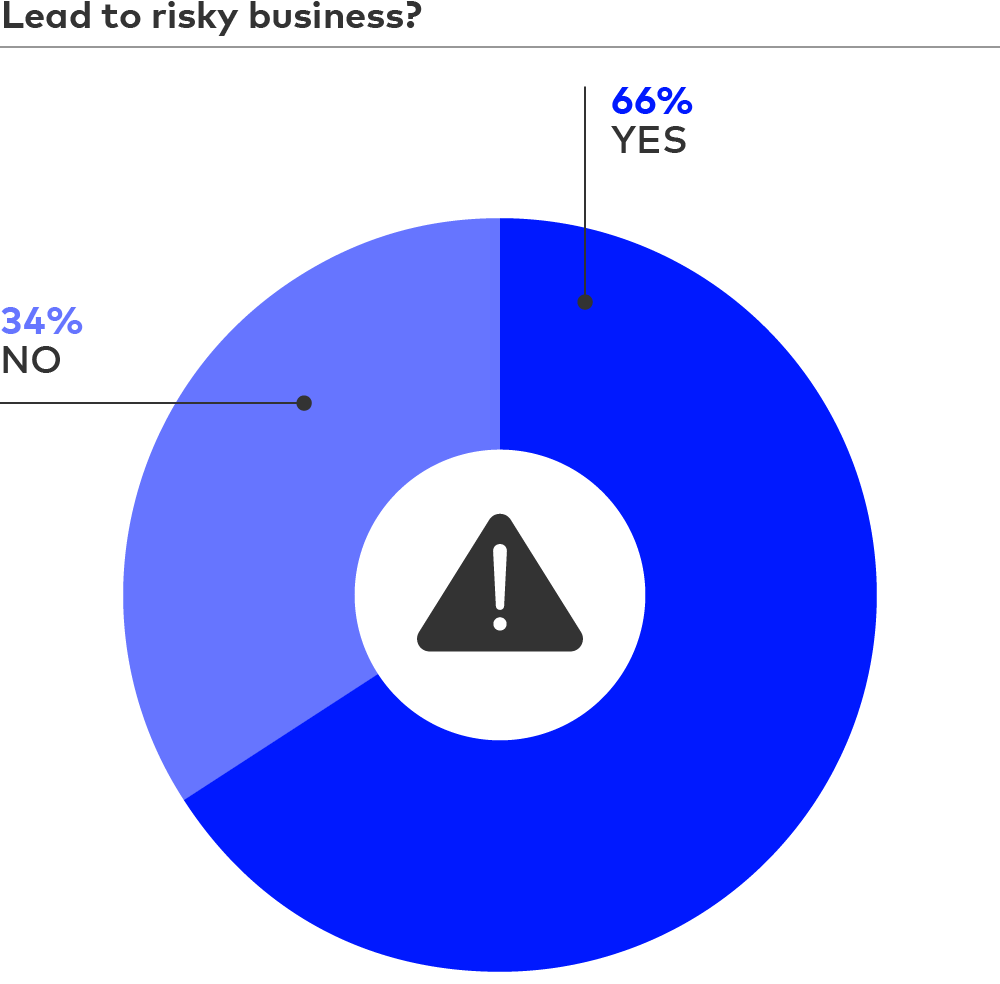

Despite a troubled past on both the efficacy and safety fronts for weight-loss drugs, GLP-1s (Ozempic and Wegovy) are all the rage, with 91% believing these new drugs will continue to have an upward trajectory from their already extraordinary early adoption. That said, growth will fade. Respondents also think these buzzy drugs have the potential to create dangerous or unethical situations, a la Cerebral with ADHD medications.

POLITICIZING MIFEPRISTONE

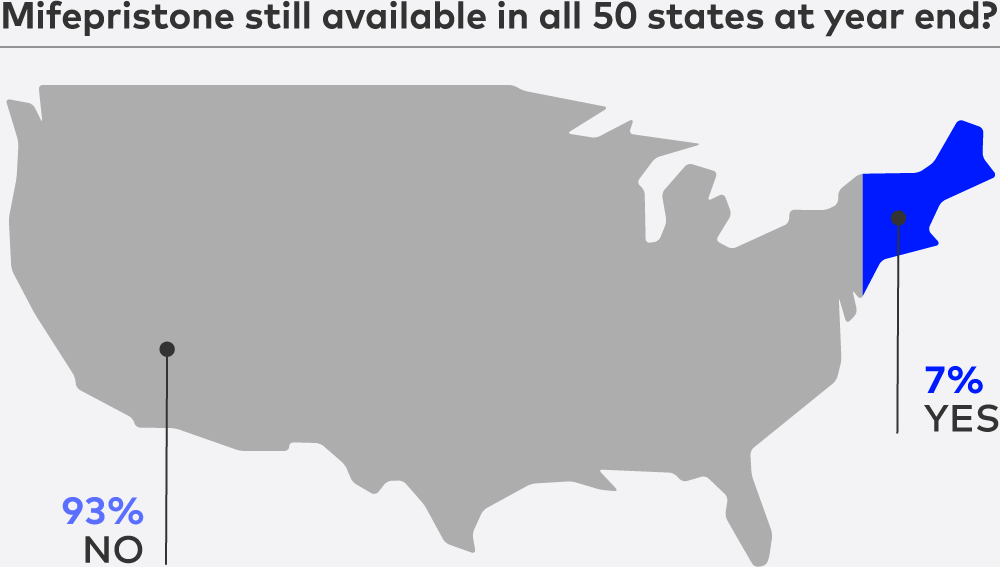

Sadly, the vast majority believe future access to the abortion drug mifepristone is uncertain in at least parts of the US due to the recent Texas lower court ruling.

LOW EXPECTATIONS FOR DRUG PRICING, AS ALWAYS

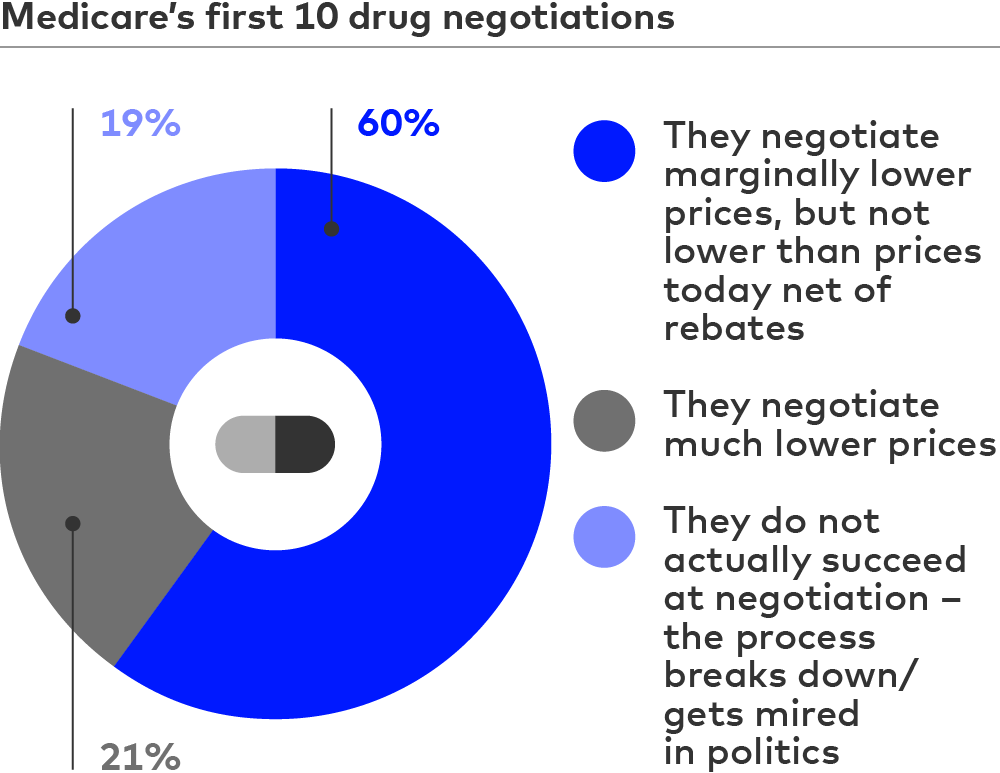

Despite the IRA and major pharma companies such as Eli Lilly, Novo Nordisk, and Sanofi announcing plans to cap out-of-pocket costs for insulin, the expectations around Medicare’s drug pricing negotiations are underwhelming. Are we correct, or are pharma’s concerns warranted?

V. POLITICS

The ongoing war between Russia and Ukraine continues to have far-reaching economic impacts worldwide. Recently leaked Pentagon documents revealed massive casualties for both countries and further complicated relations between the United States and its allies.

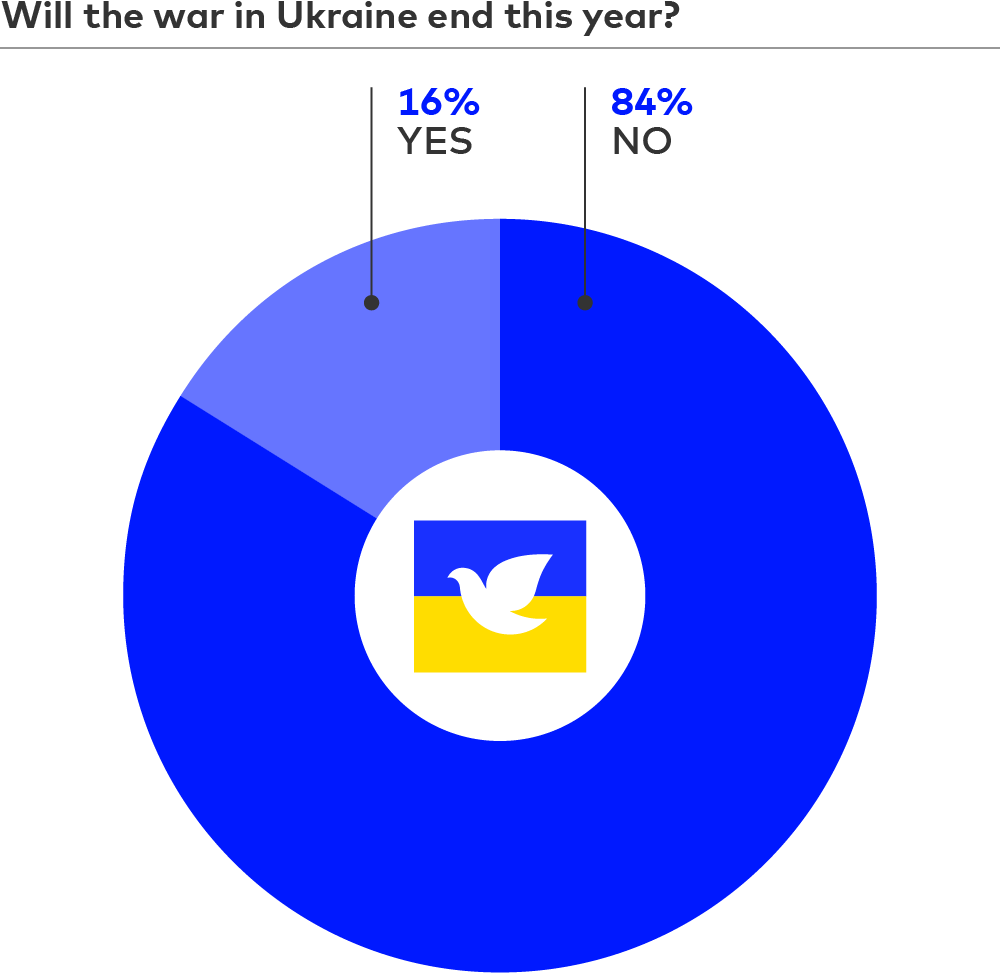

THE WAR GOES ON

A year later, Ukraine is still at war. Last year, 84% of respondents believed that Ukraine would continue to be an independent country at the end of 2022, but in 2023 they see no near term end to this war.

FULL SURVEY RESULTS

More than 300 respondents from health tech companies, large employers, insurance companies, healthcare providers, academics, the government, investors, and professional service providers conducted the survey between March 24, 2023, and April 5, 2023. If you would like to view the results of our previous surveys, you can find them here:

2022 Healthcare Prognosis

2021 Healthcare Prognosis

2020 Healthcare Prognosis

2019 Healthcare Prognosis

2018 Healthcare Prognosis

2017 Healthcare Prognosis

1

What is the likelihood of another Covid variant resulting in material business/life disruption?

| 9% | Strong possibility |

| 52% | Small chance |

| 39% | Unlikely |

2

With many large companies reversing their view on remote work and asking employees to return to the office, what is the future outlook for work?

| 8% | Returns to pre-Covid norms |

| 25% | 4 days in the office |

| 44% | 3 days in the office |

| 23% | Hybrid and flexible (no requirements) |

3

What will the adoption curves of GLP-1 drugs like Wegovy and Ozempic look like?

| 9% | LOW: They are too expensive, not cost-effective for widespread use, and payors make prior authorization hard |

| 23% | STRONG: They’re super effective, cost-effective, and are rapidly adopted for type 2 diabetes |

| 20% | RIDICULOUSLY STRONG: Same as “STRONG" but also cost-effective for weight loss and widely adopted |

| 48% | UP & THEN DOWN: Disillusionment sets in after patients experience terrible nausea, regain weight when they stop, and find the cost-sharing expensive |

4

Will the growing popularity of direct-to-consumer off-label use of GLP-1s for weight loss result in another unethical or dangerous misuse of these drugs and trigger a backlash?

| 66% | Yes |

| 34% | No |

5

In 2023, what will be the peak of the Fed Funds Rate? (5% as of3/22/23)

| 12% | Higher than 6.0% |

| 51% | 5.5 - 6.0% |

| 37% | 5.0 - 5.5% |

6

When will the Fed Funds Rate start declining?

| 2% | Q2 of 2023 |

| 12% | Q3 of 2023 |

| 22% | Q4 of 2023 |

| 30% | Q1 of 2024 |

| 20% | Q2 of 2024 |

| 14% | Q3 of 2024 or later |

7

The U.S. stock market will…

| 45% | End 2023 flat (12/30/22 DJIA Close: 33,147.25) |

| 26% | End 2023 up by more than 5% |

| 29% | End 2023 down by more than 5% |

8

What are the implications of Silicon Valley Bank’s failure (select all that apply)

| 67% | Small companies will have higher cost of capital |

| 40% | Venture debt comes with covenants that make it no longer desirable |

| 60% | It is hard to justify having corporate accounts at banks other than the “too-big-to-fail” banks |

| 55% | Other similar banks see their deposit bases shrink and they are forced to be acquired by larger banks |

| 36% | There is a big gap that another bank fills and re-creates much of SVB’s business |

| 16% | The Fed has to pause on interest rates which prolongs high inflation and adds more economic headwinds |

9

In 2023, the number of US-based health tech M&A transactions (273 in 2021; 144 in Q1-3 in 2022) will be…

| 13% | More than 225 |

| 20% | 200 - 225 |

| 32% | 150 - 199 |

| 25% | 125 - 149 |

| 10% | Less than 125 |

10

Which later-stage/small-cap public companies are most likely to be acquired, not in a fire sale, in the next 12 months? (select up to three)

| 36% | Carbon Health |

| 12% | Forward |

| 22% | Omada Health |

| 14% | Virta Health |

| 14% | Agilon Health |

| 19% | Accolade |

| 24% | Oscar Health |

| 19% | Privia Health |

| 21% | Aledade |

| 15% | Included Health |

| 22% | Calm |

| 28% | Noom |

| 10% | Spring Health |

11

Which of the following companies, expected to go public in the near future, will be the most successful public companies over the next 5 years? (select up to three)

| 15% | Included Health |

| 18% | Omada Health |

| 7% | Sword Health |

| 16% | Hinge Health |

| 38% | Aledade |

| 29% | Lyra Health |

| 44% | Devoted Health |

| 14% | Dispatch Health |

| 12% | Cityblock Health |

| 8% | Other (please specify) |

12

Earlier this year, Doximity rolled out a beta version of ChatGPT for streamlining administrative tasks. Where do you think generative AI tools have potential to make the biggest impact in healthcare? (select all that apply)

| 32% | Clinical trial recruitment |

| 48% | Drug information/Education |

| 66% | EMR documentation |

| 26% | Mental health support |

| 44% | Disease surveillance |

| 45% | Remote patient monitoring |

| 36% | Telemedicine |

| 11% | Other (please specify) |

13

Which of the following health tech sectors will experience material growth (e.g., some combination of new entrants, influx of capital, customer traction) in the next 12 months? (select all that apply)

| 28% | Accountable Care Organizations (ACOs)/Value-based Care |

| 29% | Medicare Advantage |

| 18% | Medicaid |

| 77% | Generative AI, Analytics, and Big Data |

| 27% | Digital Preventative Care Programs/Wellness |

| 11% | EHRs |

| 10% | Health Insurance |

| 36% | Virtual care/Telemedicine |

| 29% | Wearables |

| 20% | DTC services |

14

Funding for digital-health startups slumped to $15.3B in 2022, a 48% decrease from 2021's record. In 2023, funding for digital health startups will be…(select one)

| 2% | Over $20B |

| 28% | Between $15B - $20B |

| 50% | Between $10B - $15B |

| 20% | Less than $10B |

15

Will the war in Ukraine end this year?

| 16% | Yes |

| 84% | No |

16

Will you be able to get the longstanding, FDA-approved abortion pill Mifepristone filled in all 50 states at the end of 2023?

| 7% | Yes |

| 93% | No |

17

Will there be a debt ceiling default this summer?

| 19% | Yes |

| 81% | No |

18

How will Medicare’s first 10 drug negotiations go?

| 21% | They negotiate much lower prices |

| 60% | They negotiate marginally lower prices, but not lower than prices today net of rebates |

| 19% | They do not actually succeed at negotiation – the process breaks down/gets mired in politics |

19

Will President Biden succeed in additional drug price negotiations (beyond Insulin)?

| 18% | Yes, more big pharma companies will lower their costs |

| 50% | Somewhat |

| 32% | No, he will not succeed any more than he has |

20

Which category best describes your employer?

| 5% | Academia |

| 24% | Investor |

| 28% | High growth private company/startup |

| 6% | Healthcare provider |

| 2% | Healthcare payor |

| 20% | Life sciences |

| 9% | Professional services |

| 6% | Other |